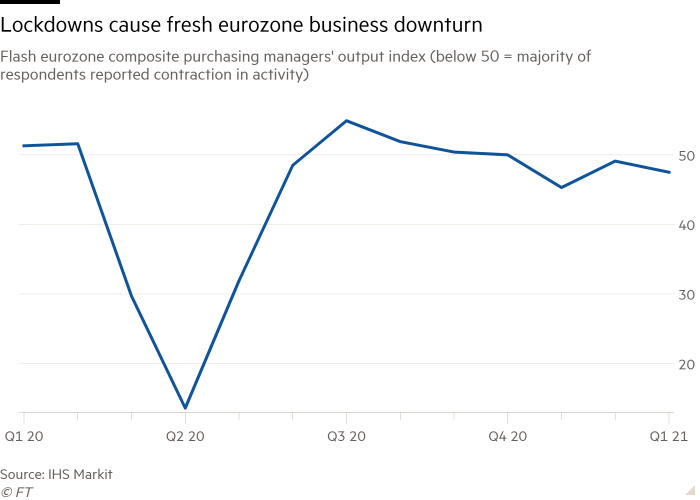

The sharp drop in eurozone enterprise exercise has deepened, based on a widely-watched survey of corporations, within the newest proof that tighter restrictions to include rising coronavirus infections are dragging the bloc in direction of a double-dip recession.

The IHS Markit flash composite buying managers’ index for the eurozone dropped 1.6 factors to 47.5 in January, its third consecutive month beneath the 50 mark, which signifies a majority of companies reported a contraction in exercise.

The near-term outlook for the eurozone economic system has darkened since a number of nations together with Germany and the Netherlands tightened lockdowns in latest weeks in response to a resurgence of the virus, main economists to forecast a contemporary financial contraction this winter. It comes after the 19-country bloc was plunged right into a historic recession within the first half of 2020 when the pandemic first took maintain.

“A double-dip recession for the eurozone economic system is trying more and more inevitable as tighter Covid-19 restrictions took an additional toll on companies in January,” stated Chris Williamson, chief enterprise economist at IHS Markit.

The gloomy figures triggered a sell-off in European fairness and debt markets; the region-wide Stoxx 600 index fell 1 per cent in Friday morning’s buying and selling, wiping out the week’s positive factors, whereas Italian authorities bond costs dropped to their lowest stage since November.

The pandemic’s second wave is fuelling a two-speed financial affect, nonetheless: the eurozone’s providers sector is hard-hit by the contemporary restrictions, with its PMI falling 1.4 factors to 45 in January, however the manufacturing PMI dropped lower than anticipated to 54.7, down from 55.2 within the earlier month however nonetheless in expansionary territory.

Sentiment about future prospects “cooled barely within the service sector” however optimism amongst producers elevated to a three-year excessive, IHS Markit stated.

Nonetheless, there have been some detrimental indicators within the manufacturing sector. “The speed of manufacturing unit output development weakened to the slowest for the reason that restoration started,” IHS Markit stated, whereas the latest sharp increase in container delivery prices between Asia and Europe induced the most important bounce in manufacturing enter prices for nearly three years.

The flash PMIs, revealed about 10 days earlier than the ultimate figures and primarily based on about 85 per cent of typical responses, are the earliest complete indicator of the financial affect of the brand new restrictions.

Jessica Hinds, economist at Capital Economics, stated the information meant the eurozone economic system would “begin 2021 firmly on the again foot”, including that the outlook for the remainder of the 12 months “hinges on the tempo of the so-far gradual vaccine rollout; extra delays will solely postpone the restoration”.

Nonetheless, Christoph Weil, an economist at Commerzbank, stated the survey outcomes “verify our view that the recession within the euro space can be a lot milder within the winter half-year 2020-21 than within the spring 2020”.

The European Central Financial institution revealed its quarterly survey of forecasters on Friday, discovering a lot of them had lower their forecasts for eurozone development this 12 months by a mean of 0.9 proportion factors, to 4.4 per cent — however their common forecasts for subsequent 12 months rose 1.1 factors to three.7 per cent.

The slowdown was felt in each of the eurozone’s largest economies.

German providers companies reported their fourth consecutive month-to-month contraction, whereas the flash providers index for France fell greater than anticipated, marking its fifth consecutive decline.

German manufacturing remained in expansionary territory for the seventh consecutive month, benefiting from rising exports, notably to China.

Phil Smith, affiliate director at IHS, stated German producers “are seemingly undeterred by the rising troubles on the provision aspect”, including that “output expectations within the sector [are] now at a file excessive”.

The composite PMI for Germany — which mixes providers and manufacturing — dropped 1.2 factors to a seven-month low of fifty.8.

The index for French manufacturing was up barely and remained in development territory. The composite PMI rating for France was down 1.5 factors at 47.

The UK’s providers sector recorded an excellent deeper decline, with its index sinking to an eight-month low after the British authorities tightened its lockdown in latest weeks following the invention of a extra infectious pressure of coronavirus.